Previous

Next

Previous

Next

Services

Critical Illness Insurance in UAE

What if, one day, things suddenly stopped going according to plan and you were diagnosed with a critical illness? Your health insurance would provide some assistance with medical bills but what about daily bills? Bills such as rent, children education fees, grocery will not stop. If you are unable to work whilst receiving treatment, paying your day-to-day expenses can become a major problem.

Critical Illness insurance in Dubai, UAE, pays out a lump sum of cash when you are diagnosed with a critical illness. It buys you peace of mind knowing that if the worst should happen, you and your family would be financially stable. This means you can focus on your recovery without worrying about your financial situation.

PLATINUM CAN FIND THE BEST CRITICAL ILLNESS POLICY IN DUBAI FOR YOUR NEEDS

At Platinum, we recommend our clients to take long-term Critical Illness coverage complemented with Life Insurance which will ensure that the clients have the resources available to help with recovery in an event from a serious illness. Critical illness insurance can

put your mind at ease. Unlike Medical Insurance, your critical illness policy will make a one-off payment. This payout can be used to pay for critical medical services/procedures that might otherwise be unavailable. This payout can also be used to pay for your mortgage, rent, or debts. Alternatively, you may choose to use your payout to make necessary alterations to your home, such as wheelchair access, should you need it. We offer our services to people in Dubai, Abu Dhabi, Sharjah, Ajman, Umm Al-Quwain, Fujairah & Ras Al Khaimah, and the entire UAE

- Aorta graft surgery – for disease and trauma

- Aplastic anaemia – resulting in permanent symptoms

- Bacterial meningitis – resulting in permanent symptoms

- Benign brain tumour – resulting in permanent symptoms

- Blindness – permanent and irreversible

- Cancer – excluding less advanced cases

- Cardiomyopathy

- Coma – resulting in permanent symptoms

- Coronary artery bypass grafts – with surgery to divide the breastbone

- Creutzfeldt-Jakob disease – requiring continuous assistance

- Deafness – permanent and irreversible

- Dementia (including Alzheimer’s disease) before age 65 – resulting in permanent symptoms

- Ductal carcinoma in situ of the breast – with specific treatment (partial payment)

- Encephalitis

- Liver failure – end stage

- Lung disease – end stage/respiratory failure – of specified severity

- Heart attack – of specified severity

- Heart failure

- Heart valve replacement or repair – with surgery to divide the breastbone

- HIV infection – caught in a specified country from a blood transfusion, a physical assault or work in an eligible occupation

- Kidney failure – requiring dialysis

- Loss of independent existence – resulting in permanent symptoms

- Loss of hands or feet – permanent physical severance

- Loss of speech – total, permanent and irreversible

- Major organ transplant

- Motor neurone disease – resulting in permanent symptoms

- Multiple sclerosis – with persisting symptoms

- Open heart surgery – with surgery to divide the breastbone

- Paralysis of limbs – total, permanent and irreversible

- Parkinson’s disease before age 65 – resulting in permanent symptoms

- Primary pulmonary arterial hypertension – resulting in permanent symptoms

- Stroke – with permanent symptoms

- Systemic lupus erythematosus – of specified severity

- Third-degree burns – covering 20% of the body’s surface area or 50% of the face’s surface area

- Traumatic head injury – with permanent symptoms

- Children’s critical illness

Full list of critical illnesses as per Zurich International Life Limited.

Other Life Insurance Products

Whole Of Life

Provides a guaranteed sum assured payable on the life assured’s passing with an investment element, which builds up a cash value as well.

Term Life

Provides a guaranteed sum assured payable on the life assured’s passing during a given point in the policy term.

Endowment Plan

Provides a sum assured should the life assured pass during the policy term or a maturity value should the life assured survive the policy term.

Business Keyman Protection

Provides a sum assured payable to the business should any high-ranking employees pass away during the policy term to assist with any financial responsibilities for the business.

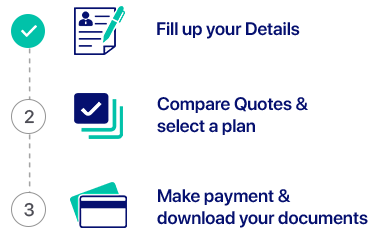

How InsurancePolicy.ae works (Simple, Speedy, Secure)

Contact Us

Speak With One Of Our Experts Today

Phone Number

Why Platinum

50 +

Years of Experience

in the Industry

35 +

Partnerships with Insurers

& Financial Institutions

10,000 +

Clients all Over the Globe

Let’s get started

Appointment

Lets Protect Your Business, Life And Much More

-

41-B Zomorrodah Building, Landmark- Huzaifa Furniture

Umm Hurair Road, Dubai, U.A.E - +971 4 357 7997, 346 6567

- +971 50 473 8811

- hello@pib.ae