Previous

Next

Previous

Next

Services

Business Keyman Protection Plan in UAE

Protecting a company’s assets is extremely important, but insuring the people and skills that make the company work is even more important. The human assets of a company are often overlooked but they are just as vital as the material ones and their loss could significantly affect the profitability, stability and progress of the company.

When a key person passes away or is critically ill or disabled, there will be a loss of income to business. Disruptive & monetary consequences of losing a Key Person through death or serious illness could have a huge impact on the business.

The need for insuring key people is vitally important in small to medium sized companies. It is thus insuring the company against the financial loss that would be suffered if something happened to the key person.

If a key person, partner or director becomes critically ill or disabled and is unable to carry on contributing to the profits of the business, the business can afford to pay the sick partner/director a salary, or buy them out of the business if required without affecting the business.

What Are The Benefits Of Keyman Business Protection?

- Sum insured can be altered at any time

- Benefits can be added or reduced

- Freedom to choose premium payment frequency

- Indexation can be added to the plan to offset the effects of inflation

- Portability of the plan enables the life insured to take on the plan If they decide to leave the business

- Choice of payment currency

Other Life Insurance Products

Whole Of Life

Provides a guaranteed sum assured payable on the life assured’s passing with an investment element, which builds up a cash value as well.

Term Life

Provides a guaranteed sum assured payable on the life assured’s passing during a given point in the policy term.

Critical Illness

Provides a guaranteed sum assured should the life assured be diagnosed with any of the specified illnesses.

Endowment Plan

Provides a sum assured should the life assured pass during the policy term or a maturity value should the life assured survive the policy term.

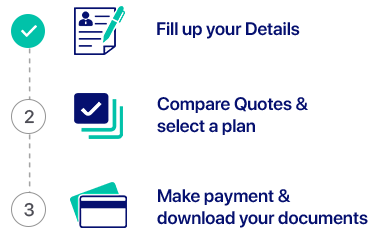

How InsurancePolicy.ae works (Simple, Speedy, Secure)

Contact Us

Speak With One Of Our Experts Today

Phone Number

Why Platinum

50 +

Years of Experience

in the Industry

35 +

Partnerships with Insurers

& Financial Institutions

10,000 +

Clients all Over the Globe

Let’s get started

Appointment

Lets Protect Your Business, Life And Much More

-

41-B Zomorrodah Building, Landmark- Huzaifa Furniture

Umm Hurair Road, Dubai, U.A.E - +971 4 357 7997, 346 6567

- +971 50 473 8811

- hello@pib.ae