Marine Cargo insurance in the UAE is an insurance policy that provides coverage for goods and merchandise during transportation by sea.

It is designed to protect the interests of exporters, importers, and cargo owners against various risks that can occur during transit.

In the UAE, marine cargo insurance is typically offered by insurance companies and brokers operating in the country. These insurance providers offer policies that cover a range of risks, including but not limited to:

Loss or damage to cargo:

This covers the loss or damage to goods caused by perils such as fire, theft, collision, sinking, or rough handling during loading and unloading.

General average:

In certain situations, when a vessel is in danger, sacrifices may need to be made, such as jettisoning cargo to save the ship. In such cases, general average covers the proportional contribution of all parties involved in the cargo to compensate for the loss.

Delay or detention:

This covers the additional expenses or loss of profit incurred due to a delay or detention of the cargo beyond the agreed-upon time.

War and strikes:

This covers losses or damages resulting from war, strikes, riots, civil commotion, or other similar events.

Natural disasters:

Coverage is provided for losses caused by natural disasters like storms, earthquakes, tsunamis, or floods.

To obtain marine cargo insurance in the UAE, individuals or businesses need to approach insurance companies or brokers and provide relevant details about their cargo. This includes the nature of the goods, their value, and the intended destination. The insurance provider will assess the risks involved and provide a quote for the insurance premium based on the cargo’s value and the chosen coverage.

It is important to carefully review the terms and conditions of the insurance policy, including any exclusions or limitations, before finalizing the coverage. Additionally, it is advisable to work with reputable insurance providers who have experience in marine cargo insurance and a good track record in claim settlement.

Please note that insurance policies and regulations can vary, so it is always recommended to consult with a licensed insurance professional or seek information from the specific insurance provider in the UAE for accurate and up-to-date details regarding marine cargo insurance.

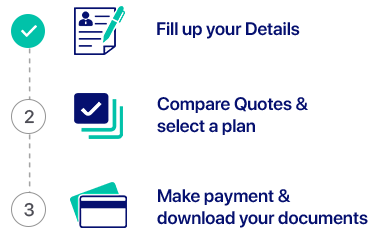

To take marine cargo insurance in the UAE, you can follow these general steps:

Identify your insurance needs:

Determine the type of cargo you want to insure, its value, and the level of coverage required. Consider factors such as the nature of the goods, the destination, and any specific risks associated with the transportation.

Research insurance providers:

Look for reputable insurance companies or brokers in the UAE that offer marine cargo insurance. Consider factors such as their experience, financial stability, customer reviews, and the range of coverage options they provide.

Contact insurance providers:

Reach out to the insurance brokers in UAE you have shortlisted. You can either visit their offices, contact them via phone, or visit their websites to request information or a quote.

Provide relevant details:

When communicating with the insurance provider, be prepared to provide details about the cargo and any special requirements. The insurer will assess the risk and provide a premium quote based on the provided information.

Review policy terms and conditions:

Carefully read and understand the terms and conditions of the insurance policy, the coverage, exclusions, limitations, and any deductibles. Ask the insurer any questions you may have to ensure you fully understand the coverage.

Accept the policy and pay the premium:

If you are satisfied with the coverage and terms, you can accept the insurance policy. The insurance provider will provide you with the necessary documents.

Maintain documentation:

Ensure you retain important records such as the insurance policy, premium payment receipts, and any related correspondence.

It’s important to note that the specific process and requirements may vary depending on the insurance provider. It is advised to contact the insurance provider directly to learn about their specific procedures.